As a small business owner, you have a lot on your plate. From the moment you conceived of your small business idea to writing the business plan, obtaining financing, finding a location, hiring employees, opening your doors, and now managing the growth of your small business, you are constantly on the go, attending to matters. Thus, when it comes to a bookkeeping task, such as payroll, which is usually every two weeks, you have to find time to do that as well. Or, should you outsource?

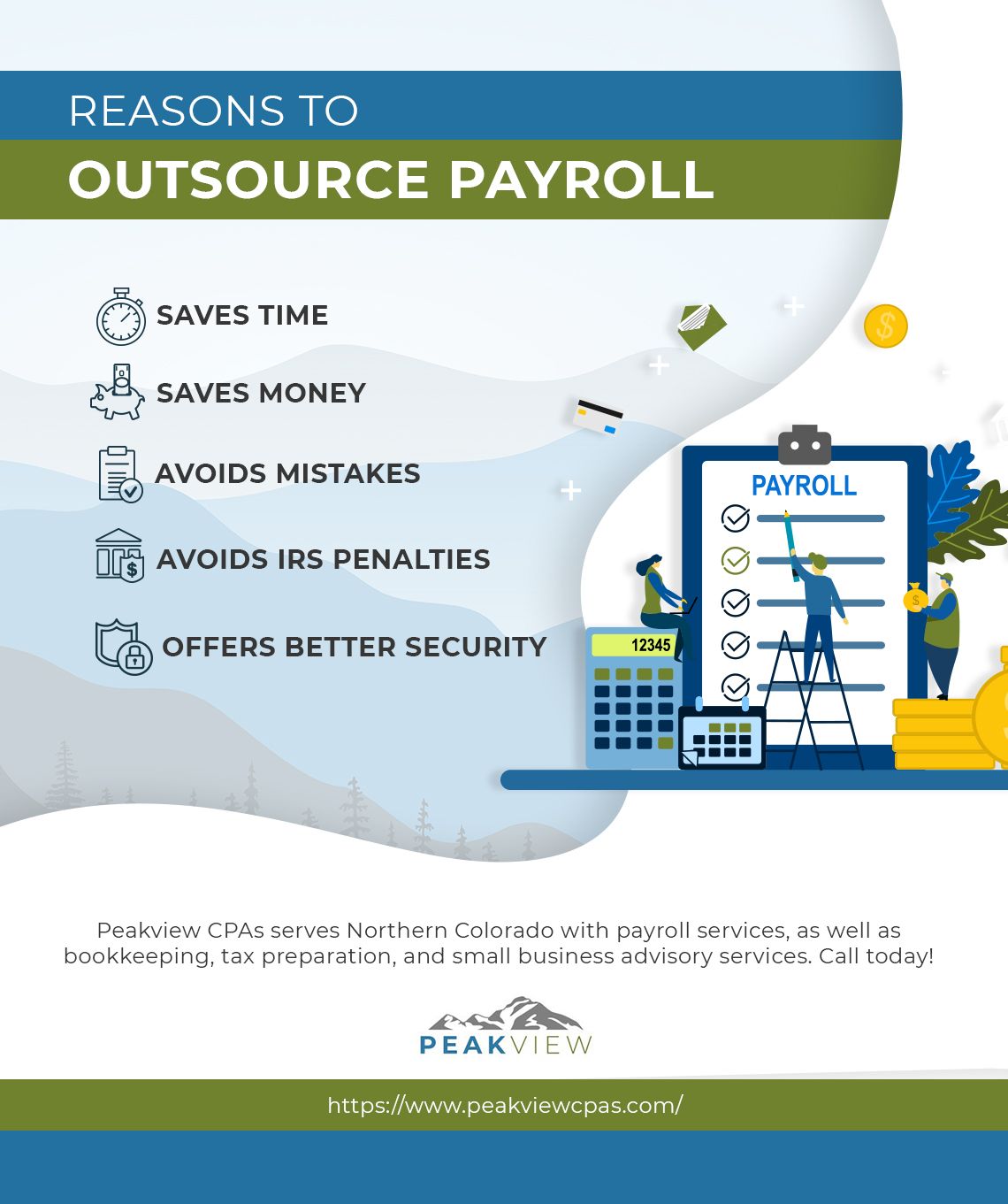

Peakview CPAs serves Northern Loveland with the best accounting, bookkeeping, and CPA services. We also offer tax consulting services. We have over 50 years of combined experience in helping our clients with small business CPA services. Our mission is to go the extra mile for our clients in finding tax deductions and other ways to save money. As part of our bookkeeping services, we offer payroll processing as well. Below, we’ll review some of the reasons to outsource payroll for your small business. Contact our CPA company for small businesses today to get started!